The Definitive Guide to Car Insurance Coverage Calculator - Geico

The less experienced the driver, the greater the rates. That's since statistically, inexperienced motorists crash a lot and so they are the riskiest category of motorists to guarantee. Cars and truck insurance coverage rates show this high risk. Naturally, the vast bulk of inexperienced chauffeurs are teens and those under age 25.

All of this helps insurance companies recognize the threat associated with insuring your automobile in that ZIP code, whether you ever have actually made a claim or not. How does my marital status impact my cars and truck insurance rate?

There are likewise other vehicle insurance discount rates couples can look forward to when they combine their policies, such as a multi-car discount, or a multi-policy discount rate if they have an occupants or house owners policy with the exact same insurer. An insurance company considers you single if you have actually never ever been wed, or are widowed or divorced. risks.

For example, some insurance companies reject anybody with 4 or more chargeable accidents in 3 years, or more than three DUIs in 7 years, or more than 15 points on the driver's automobile record. In basic, a small violation such as a speeding ticket can increase your rates, usually, by 25% to 43%.

5% less, on average, compared to drivers with longer commutes, a Cars and truck, Insurance. How does mileage affect automobile insurance rates? If you drive 12,000 miles a year, or less, your insurance business will typically consider that to be lower than average, and you'll likely pay a lower rate than those who drive more than that.

To get the finest low-mileage discounts, which are about 7% typically, you normally need to drive under 7,000 or 5,000 miles each year. Based upon a Los Angeles chauffeur with a complete protection policy, the expense of a policy when the chauffeur logged 20,000 or more miles was 12% more pricey than if simply 5,000 miles were driven a year.

We asked Charles, the following questions about credit report and insurance rates: What are the pros and cons of utilizing a driver's credit rating when setting automobile insurance coverage rates? Recognizing and rewarding drivers with great credit routines can yield consistent income and organization stability for insurance companies. A customer's credit rating says a lot about them.

The smart Trick of Car Insurance - Get An Auto Insurance Quote - Allstate That Nobody is Talking About

In the long term, insurance provider's development could be restricted if some customers are priced out of the market, this can have a cascading impact where lower sales lead to lower revenues and lower ROI. It might be best to take calculated risks and make policies available at affordable rates to those with lower credit scores (cheaper car).

Let's choose a firm perhaps. Traditional customers, with good credit report, are an essential base for a solid insurance organization. These consumers correspond about paying their costs and insurers should reward them with the very best rates. On the other hand, those with low or weak credit scores might have fallen into a bad spot and had trouble paying costs for a duration, but that doesn't instantly mean that they're going to be careless on the road. credit.

But insurance companies are everything about danger and numbers, and if their research says that individuals with bad credit are frequently bad motorists, one could make the argument that charging greater threats is reasonable. Even if it sort of seems like the insurance provider is kicking the person with bad credit while they're down.

Customers with low credit report in some cases won't receive regular monthly billing, or they might require to pay a large portion of the policy in advance and the rest monthly. In any case, reasonable or not, credit history typically do have an effect on one's insurance coverage premiums. If you desire them to go down, it makes sense to attempt to make your credit rating go up.

The more protection you get, the more you will pay. If you get a bare-bones liability policy that covers just what the state needs, your cars and truck insurance coverage costs are going to be less than if you bought protection that would fix your own cars and truck, too. Liability protection tends to cost more due to the fact that the amount the insurance business dangers is greater - cars.

Medical costs and multiple-car accidents might press a liability claim into the hundreds of thousands of dollars. If you do not have sufficient liability protection, you might be demanded the difference by anyone you hurt. Comprehensive and collision damage is affected by the deductible you pick. The higher the deductible, the less the insurer will need to pay-- and the lower your rates.

Without some type of medical coverage, if you do not have health insurance coverage in other places, you may not be able to spend for treatment if you are injured in a mishap you triggered. One method some motorists can restrict their insurance coverage expenses is with pay-as-you-drive insurance. This type of insurance coverage bases the cost of your premium on how much you drive, and may take into account other driving routines.

Excitement About Does Car Insurance Go Down At 25? - Experian

Otherwise, these motorists "pay roughly the very same annual repaired expenses for insurance as another motorist with high yearly mileage. So, low mileage motorists would have the greatest rewards to switch to pay-as-you-drive."Besides potentially conserving cash for low mileage chauffeurs, pay-as-you-drive insurance coverage could provide a reward to drive less. Explains Parry: "By raising the limited cost of driving it would influence people to drive a bit less - particularly for those with high threat elements as shown in high rating elements (as they have greater insurance costs per mile)."Parry adds that the benefit of this reward to drive less might extend beyond the money saved by consumers with pay-as-you-drive insurance."There would be some modest take advantage of minimizing opposite effects from automobile use - some modest reduction in carbon and regional air emissions and traffic blockage as aggregate car miles driven is moderately reduced."Just how much is automobile insurance annually? Here's how much the typical chauffeur, with great credit and a clean driving record, would pay for the following coverage quantities, based on Car, Insurance coverage.

The average rate for 50/100/50 is. The average rate for 100/300/100, with thorough and crash and a $500 deductible is (low-cost auto insurance). Bumping state minimum as much as 50/100/50 expenses just $129, so it's almost $11 a month-- Going to 100/300/100 from 50/100/50 costs, to double your liability protection.

Average rates are for relative functions. Your own rate will depend on your personal factors and car.

Insurance providers wish to see shown accountable behavior, which is why traffic mishaps and citations are consider determining cars and truck insurance coverage rates. Points on your license don't remain there forever, but how long they remain on your driving record differs depending on the state you live in and the seriousness of the offense.

A brand-new sports cars and truck will likely be more costly than, say, a five-year-old sedan. If you pick a lower deductible, it will result in a greater insurance coverage costs which makes choosing a higher deductible seem like a pretty good deal. Nevertheless, a higher deductible could imply paying more out of pocket in case of an accident.

What is the typical automobile insurance coverage expense? There are a large range of aspects that influence just how much automobile insurance expenses, which makes it difficult to get an accurate idea of what the typical individual pays for car insurance (cheaper car). According to the American Vehicle Association (AAA), the average expense to insure a sedan in 2016 was $1222 a year, or around $102 each month.

How do I get vehicle insurance coverage? Getting a vehicle insurance price quote from Nationwide has actually never been much easier - vehicle.

The Best Guide To Minority Neighborhoods Pay Higher Car Insurance Premiums ...

In nearly every state, a minimum of some amount of cars and truck insurance coverage is required by law to get behind the wheel. Being legally required, cars and truck insurance coverage is crucial to keep you protected from the financial problem of a variety of bad things that can take place in, around, and to your car. cheap car.

We'll break down how we price Lemonade Vehicle policies, so you can get the realities and request the protection you need with self-confidence. auto insurance. The most simple method to get a sense of how we price Lemonade car insurance coverage is by making an application for protection. It's fast, simple, and simple to compare.

Picking a higher deductible will usually lead to lower premiums, since it implies you 'd be responsible for more of the preliminary expenses in case of a mishap. car insurance. What the cost of Lemonade Automobile covers If you desire to take a deep dive into all of the protection types provided by Lemonade Cars and truck, we've got you covered here.

If you're interested in finding out more about a policy with Lemonade Automobile, the most convenient way to explore your coverage optionsand what you 'd payis by obtaining a quote. It's quick, simple, and even a little enjoyable.

Average Cars And Truck Insurance Coverage Rates by Protection Level When it pertains to safeguarding your car, we comprehend that everybody's needs are different. That's why we provide different kinds of cars and truck insurance protection. Having full protection assists you stay safe on the roadway. This is likewise one of the reasons the average expense of car insurance coverage varies in between consumers.

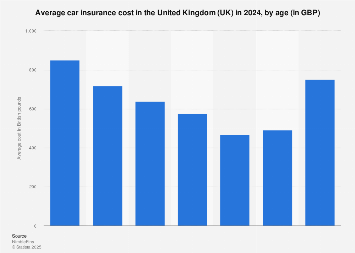

A policy that will pay for property damages up to $50,000 will have a greater premium than one that just pays for repair work up to $25,000. Average Cars And Truck Insurance Coverage Rates by Age Your vehicle insurance coverage rates will also vary based on your age group.

Typical Cars And Truck Insurance Coverage Rates by State The average cars and truck insurance coverage rate by state varies. According to the Insurance Coverage Details Institute (III), Iowa has some of the most affordable car insurance in the country at $674, while Louisiana had some of the most pricey at $1,443.

Unknown Facts About How Much Does It Cost To Charge A Tesla? (And Is It Worth It?)

At What Age Is Cars And Truck Insurance Cheapest? Generally, cars and truck insurance premiums cost more for motorists who are younger than 25. 5 That suggests as a motorist gets older and acquires more experience on the road, their rates will likely reduce. 6 For some people, these rates can start to increase once again after the age of 65 when you're thought about a senior. low cost.

Which Age Pays the Most for Automobile Insurance? Insurance provider normally charge more for chauffeurs that are under the age of 25. 7 If you are 50 years or older, you satisfy the AARP member age requirement and can obtain coverage with The Hartford (liability). Given that 1984, The Hartford has assisted nearly 40 million AARP members get the vehicle coverage they require through special advantages and discounts What State Has the Least expensive average cars and truck insurance coverage rates? According to III, in 2017, these states had some of the least expensive automobile insurance rates:8 To get more information, get a quote from us today.

They'll assist you get the vehicle policies you need, whether it's to help pay for damages after a mishap or to safeguard you from accidents with uninsured motorists. trucks.

In this article, we'll check out how typical cars and truck insurance coverage rates by age and state can change. We'll likewise have a look at which of the best vehicle insurance companies offer good discount rates on cars and truck insurance coverage by age and compare them side-by-side. Whenever you shop for automobile insurance, we recommend getting quotes from multiple providers so you can compare protection and rates.

Why do average cars and truck insurance rates by age differ so much? Generally, it's everything about risk. According to the Centers for Disease Control and Avoidance (CDC), people between the ages of 15 and 19 represented 6. 5 percent of the population in 2017 however represented 8 percent of the total expense of automobile accident injuries.

The rate information comes from the AAA Structure for Traffic Security, and it represents any accident that was reported to the cops. The average premium information originates from the Zebra's State of Vehicle Insurance coverage report. The prices are for policies with 50/100/50 liability coverage limits and a $500 deductible for extensive and accident protection.

https://www.youtube.com/embed/JWWBOyTgfus

According to the National Highway Traffic Safety Administration, 85-year-old males are 40 percent more most likely to get into a mishap than 75-year-old guys. Looking at the table above, you can see that there is a direct correlation between the crash rate for an age group and that age's average insurance premium. cheaper.